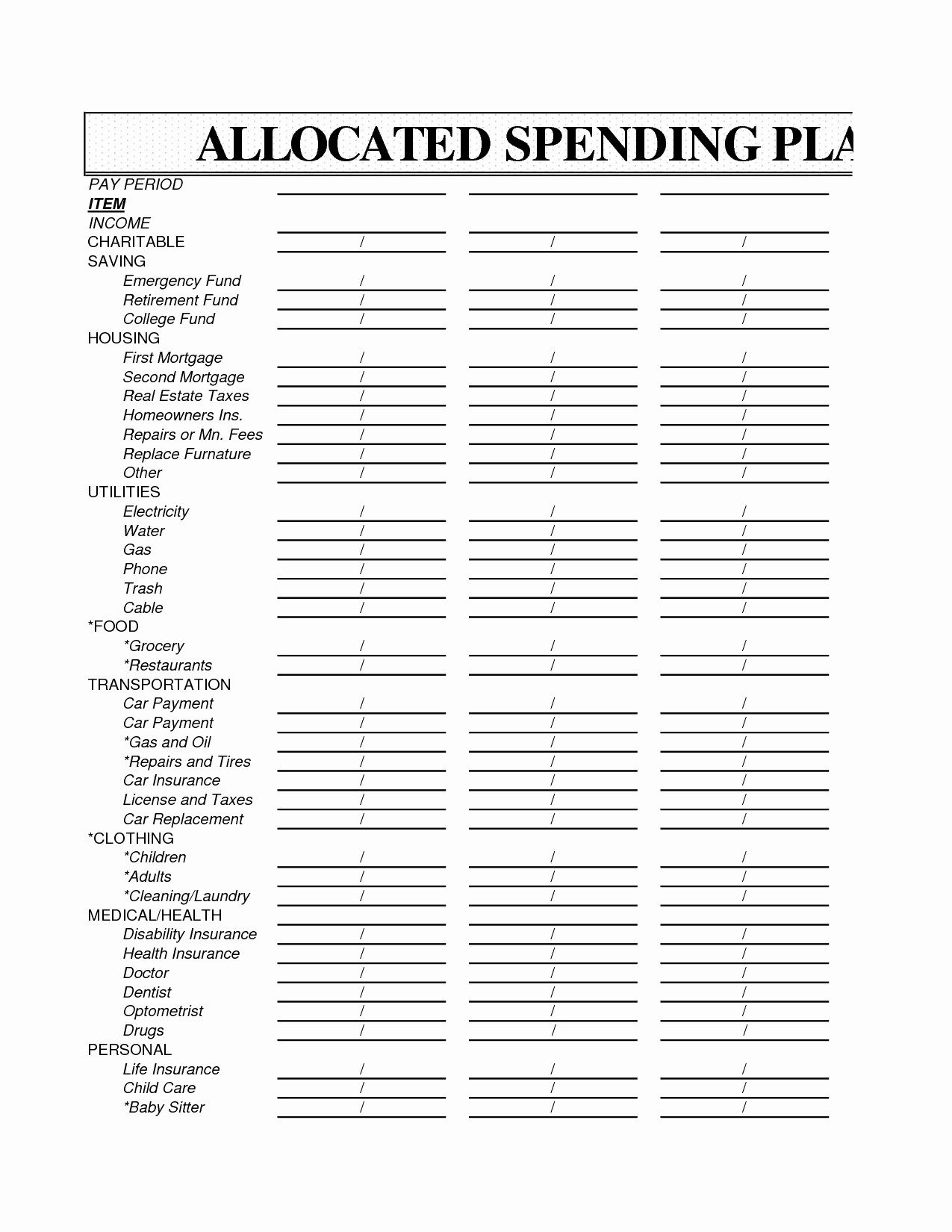

If you have money left over after you’ve subtracted all your expenses, be sure to put it in the budget too! Otherwise, you’ll end up mindlessly spending it on coffees and those one-click deals of the day. That doesn’t mean your bank account is at zero: It means every bit of your income has a job. When you subtract your income from your expenses, it should equal zero. Budget Step 3: Subtract your income from your expenses. Then use your online bank account or those bank statements to estimate planned amounts for everything else based on your spending in the past months. We’re talking about insurance, debt, savings, entertainment and any personal spending.

Just make a really good estimate, and you’ll learn what you actually need here in the month ahead. Others change up, like groceries.Īnd hey, that grocery budget line is pretty hard to guess at first. Some of these are called fixed expenses, meaning they stay the same every month (like your mortgage or rent). Start by covering your Four Walls-aka food, utilities, shelter and transportation. It’s time to list your expenses! (Pro tip: Open up your online bank account or look at your bank statement to help you estimate your expenses.) Now that you’ve planned for the money coming in, you can plan for the money going out. (You can adjust later in the month if you make more.) Budget Step 2: List your expenses. If you’ve got an irregular income, put the lowest estimate of what you normally make in this spot. Write down each normal paycheck for you and your spouse-and don’t forget any extra money coming your way through a side hustle, garage sale, freelance work, or anything like that.

0 kommentar(er)

0 kommentar(er)